Creating a financial planner is an important step in achieving your financial goals. A financial planner can help you track your spending, set financial goals and create a plan to achieve those goals. Here are some tips to help you create a financial planner that works for you:

1. Define your financial goals: Before you can create a financial plan, you need to know what you want to accomplish. Your goals could be saving for a down payment on a house, paying off debt or saving for retirement. Write down your goals and be specific about how much money you want to save and by when.

2. Keep track of your expenses: Knowing where your money goes is an important step in making a financial plan. Keep track of all your expenses for a month and categorize them, such as housing, transportation and entertainment. This will help you see where you can cut back and save more money.

3. Create a budget: Once you know where your money is going, you can create a budget that will help you reach your financial goals. A budget is a plan that shows how much money is coming in and how much you are spending. It also shows where you can cut back and save more money.

4. Make a plan to achieve your goals: Once you have a budget, you can make a plan to achieve your financial goals. This could be paying off debt, saving for a down payment on a house, or saving for retirement. Your plan should include specific steps you will take, such as paying off a certain amount extra on your debt each month, or increasing the amount you save each month.

5 Evaluate and revise your plan: Your financial situation and goals may change over time, so it’s important to regularly evaluate and possibly revise your financial plan. This will help you stay on track and ensure that your plan is still working.

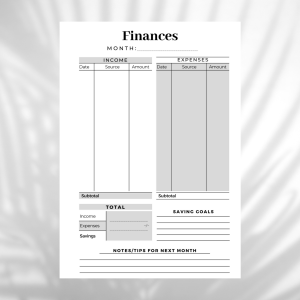

Financial inserts

To make your financial planner a success, we have a number of useful inserts & accessories;

You can easily add these inserts to your planner and keep a good overview each month.

Conclusion

Creating a financial planner is an important step in achieving your financial goals. It allows you to set financial goals, track your expenses, create a budget and create a plan to achieve those goals. By reviewing and revising your financial plan regularly, you can make sure it is still working for you. Remember that creating a financial planner is an ongoing process and you must remain committed to achieving your financial goals. Therefore, think of your financial planner as a tool that helps you navigate your finances in an efficient and organized manner. Tailor it to your specific needs and use it to achieve your goals.

Contact

Still have questions after reading this article, or need help putting together your financial planner? Then contact us by using the button below.